If you're reading this, you probably don't need me to tell you that the Venture Capital (VC) industry is evolving at lightning speed. Enabled by technology and further accelerated by COVID-19, companies have fast-tracked their digitisation and consumer demands have changed dramatically.

This "fourth industrial revolution" (4IR), as coined by Klaus Schwab (the founder and executive chairman of the World Economic Forum) has triggered a profound change in economic and social structures, and in turn, changed the face of the VC industry.

So much so that much of the VC literature and resources available to the public either concentrate solely on the past or simply feel outdated. There's much comparison between VC and PE, the key players, and unicorn statistics; however, research and articles on the industry's transformation and future state, and how that might impact VC investment strategy and portfolio construction selection for LP investors, is limited.

I felt this pain first-hand when I was interviewing for my current role at Antler. Having spent over 13 years in the financial industry, as well as being an avid investor, I certainly had a good understanding of private markets but I was hungry to sharpen my VC knowledge, and so undertook many hours of research in preparation. However, as foreshadowed, what I found was lacking.

To solve this, Antler is setting out to fill this knowledge gap by releasing a new series of reports which will delve into the global Venture Capital industry, leveraging the expertise and insights of the Firm's global leadership team and executives. These reports, released on a quarterly basis, will seek to uncover real impact and expose potential risks in the industry, as well as explore sustainable measures and practices, and future opportunities across the sector for investors and entrepreneurs.

In anticipation, this is a quick primer to set the stage for our upcoming series.

Let's start with a quick overview of the industry right now.

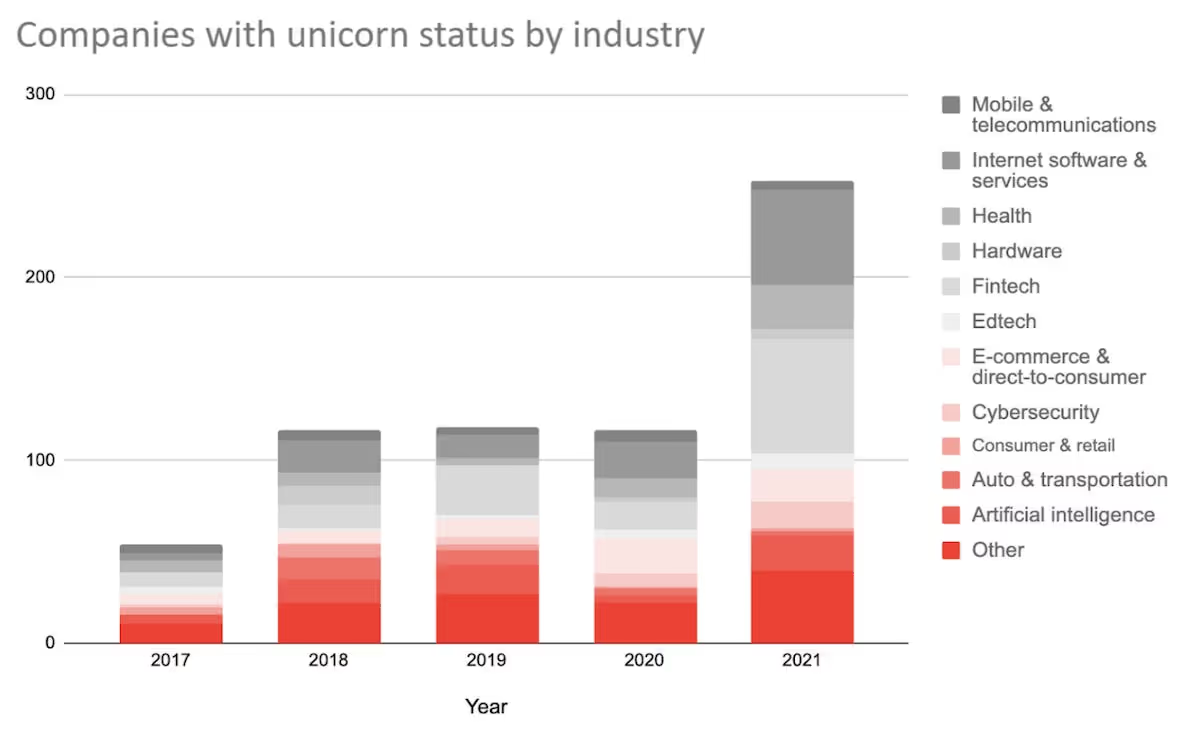

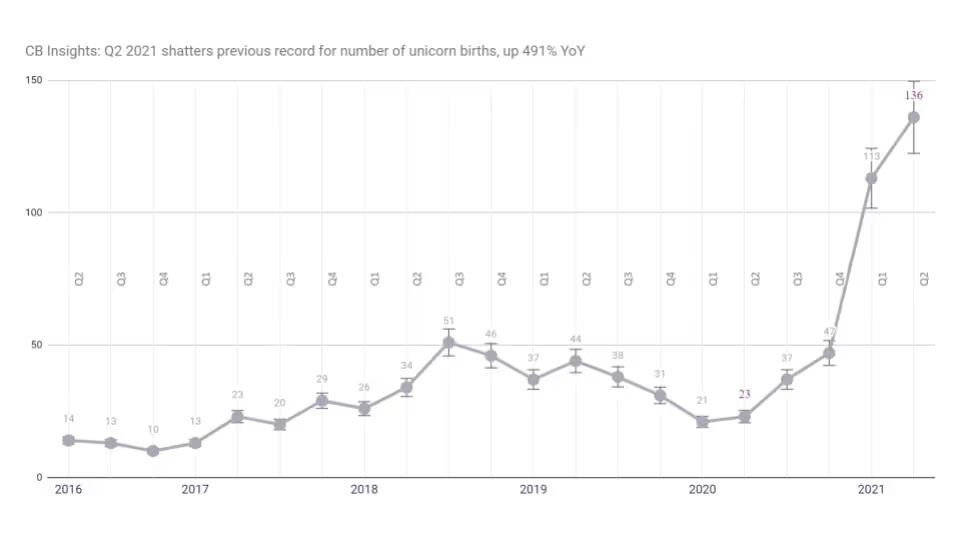

CB Insights research showed that more unicorns were created in the second quarter of this year than in all of2020. From comparing the data to previous years, the emerging trend of globalisation is truly interesting. These US$1+ billion private companies can be created anywhere in the world and in any industry.

Technology-enabled innovation

And of these companies being created, it's becoming evident that in an age of connectivity and intelligence that blockchain, 5G, AI/ML, and, of course, cloud will continue to have a huge impact.

Accenture CEO Julie Sweet said recently that currently only 20% of businesses are using the cloud, but by 2025, 80% of companies will be in the cloud.

Nothing has given entrepreneurship a greater companion than innovation in technology. And when it comes to investing in these innovative companies, VC is a catalyst.

Nothing has given entrepreneurship a greater companion than innovation in technology.

A paper written by economists in 2019 states that both employment and patenting data show that VC-backed firms are likely to achieve greater success and contribute more significantly to the aggregate economy. In fact, they estimated the absence of VC funding would lower aggregate growth by 28%*. The VC ecosystem is already fundamental to support new companies that are defining tomorrow but this report also concludes that they can significantly contribute to economic improvements for country GDP as well.

Innovation within technology will drive business solutions, products, and services. No one can argue that there is a plethora of potential investment opportunities which VC is at the forefront of. We do however need to be mindful that with great change comes challenges, too. For one, VC has become popular.

The industry is booming

The first is, in my opinion, the stealth destruction of our global economy, and the second is investor's demand for return and diversification beyond public markets.

Quantitative Easing, or QE, was supposed to be a short-term measure to support the economy after the GFC. Yet, here we are many years later, prolonged historically low yields and a whopping US$8.2 trillion on the Federal Reserve's balance sheet, up from less than US$1 trillion before the crisis (source: American Action Forum as of 28 July 2021). Investors were forced up the risk spectrum to find returns. I believe this enabled the creation of the first trillion-dollar companies; now enjoying soaring valuations at multiples not seen since the dot.com bubble and causing index over concentration. Most of these make up FAAMG (Facebook, Apple, Amazon, Microsoft and Google) (or are at least very close to reaching a trillion market cap) and they are performance outliers.

In 2020, FAAMG returned 56% on a cap-weighted basis, while all other US stocks returned 15% in aggregate. As of July 2021, the worst-performing FAAMG stock, Alphabet, has returned more than double the index average since the market bottom in March 2009. I should note here, four out of the five were built with the help of VC firms. We have seen retail investors drive valuations through social media group movements (I'll just say GameStop here), which bring its own challenges to fundamental investing in public markets. One could argue this type of behaviour further encourages more companies to stay private for longer, a trend that was already here.

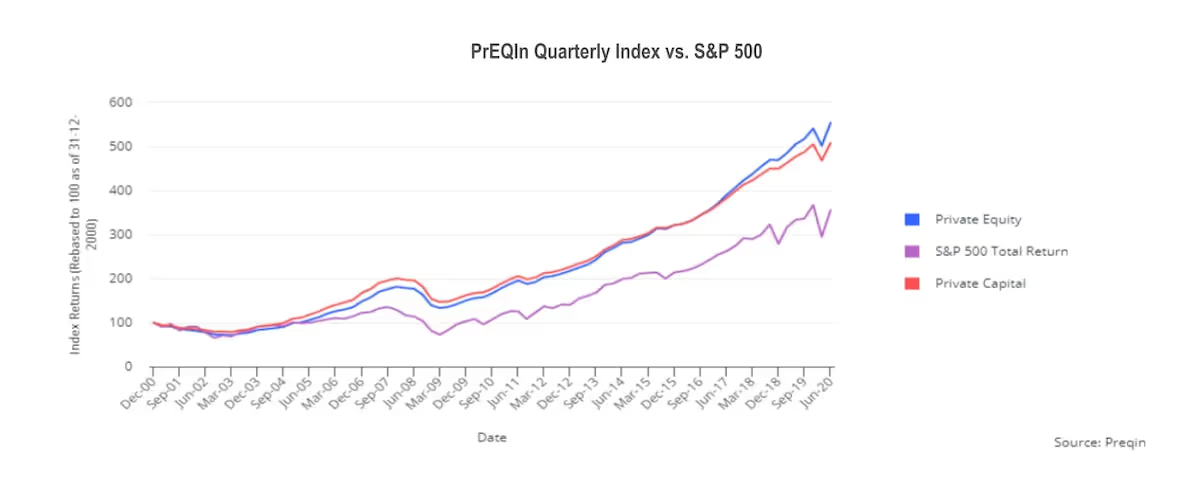

A McKinsey study published in April 2021 showed that private equity outperformed reasonable public market benchmarks over the last five, ten and twenty year periods. Private markets have also shown remarkable resilience over the last 18 months during the pandemic and crises in general in its history. It is, therefore, no surprise that asset allocators have been increasing their allocations to private markets not just for diversification and return but for impact as well.

Even back in 2019, Cambridge Associates published a report with a recommendation to allocate more than 15% of a portfolio to VC; they believed this to be particularly appropriate for private investors.

Let's look to Goldman Sachs, as another example. In their recent inaugural report on family offices, Goldman stated that their survey respondents have a mean allocation to PE/VC of 24%. The report also said thatVC investing continues to be top of mind among family offices, directly and through funds, with more than 90% of respondents globally investing in the space. They did however, also indicate that family offices find sourcing and evaluation increasingly more challenging. Greater competition for deal flow, performance dispersion and differentiation across VC managers are just some of the consequences of increased capital inflows; and are topics we will discuss further in the series.

New players are emerging

Turning to the size of the industry, the last credible count of the number of active VC investors was back in 2017 at 4,589, according to PitchBook's Private Markets Guide. Over 10 years this number is estimated to have increased163% and has already reached a value of US$197.7 billion in 2020, according to research done by the consulting firm IMARC. Looking forward, this market value is projected to reach US$419.8 billion by 2026, expanding at a CAGR of 15.90%.

Such growth may explain the overhyped enthusiasm for Special Purpose Acquisition Companies (SPACs) and the proliferation of funds on VC platforms which make VC suddenly accessible to anyone. Take Robert Downey Jr's fund, it's just one example out of new emerging funds from celebrities. Is this an early sign that investment is going to experience an influencer takeover?

It is important as an investor to take a step back to assess how the investment universe has changed and what it might look like in the future.

While growth, investor awareness, and media attention are all great for the VC industry; at this pace of change, it is important as an investor to take a step back to assess how the investment universe has changed and what it might look like in the future before making a decision that could lock your capital for up to 10 years (even if it is worth it).

We can accept the importance of VC and its deserved place in an investor's portfolio. We can appreciate the growth rate opportunities for getting invested at the early stage as well as the power of partnership with founders. But it is also the right time to think about what the most appropriate investment approach and strategy is to adapt to this changing landscape - how to filter out the noise and access the best opportunities offered by the global VC stage over the long term. The spotlight is on the VC industry, but we are really only just beginning the story.

Over the coming months, Antler's reports will consider:

I work at a company that enables and invests in companies globally through a presence across 16 innovation hubs around the world. We see these companies solving real-world problems and harnessing the power of technology to decide what our tomorrow looks like. These new trends and innovations emerging on the ground shape our insights and decision-making, and we're excited to share our findings.